Large Enterprise Merchant PayPal Account End-to-End

Support the creation of a best-in-class large-enterprise payments system by discovering touch-points for improvement, identifying opportunities for market differentiation, and creating an end-to-end framework for a cohesive experience.

Team

Phase: Discovery

My Role: Design Lead of a team of 5 designers, including a content writer and researcher

The team also included a Product Manager, and Project Manager

Audience / Stakeholders: Bi-weekly share-outs with Senior Leadership

Sr. Director, Head of Product // Sr. Director, UX // Sr. Director, Developer Ecosystem // Sr. Director, Product Management - Tech

IN SCOPE

A single framework to connect and improve touch-points across the merchant PayPal experience, including these spaces and segments:

Large and Mid categorized Businesses

White glove services and self serviced

PayPal branded and internal “non-branded” products

Developer and Sandbox

Onboarding onto the merchant experience

Servicing products & Reporting

Payment disbursement

Frontbook (new users) and Backbook (onboarded users)

OUT OF SCOPE

Single-domain designs for engineering spec, as well as these spaces:

Partner segment

Small Businesses or Consumer

Mobile App

Geo expansion

Project NorthStar

Backbook / migration plan

CONSTRAINTS TO ENABLE ACCELERATION

The team was working largely without a North Star vision. The end result of our work would therefore provide individual teams to “plug” detailed solutions into the proposed framework. We spent many meetings interviewing domain experts to learn about existing experiences indentifying happy and unhappy paths to influence our decisions. We leverage the existing unified platform, research, and Merchant UI 2.0 designs to influence design and user needs to solve the user needs.

My role was to centralize and visualize the merchant experience so cross functional teams and leaders could understand the power of the platform and build a product vision/strategy leveraging merchant user and business needs.

Approach

CUSTOMER BENEFITS

SPEED & EASE

One integration, efficient onboarding

Reduce investments in time, effort, and capital

Enable multiple functionalities with single integration

Centralized onboarding and data collection

SCALABLE

Run and grow the business

Singular servicing portal with insights/data from multiple channels

Reduced effort to scale into new markets

Easier account creation and user management

FLEXIBLE & AUTOMATED

Securely support enterprise workflows

Maintain compliance with growth into new markets

Automation of permissions

Protect platform through proactive risk management

BUSINESS OUTCOMES

DEFINE FOUNDATION

Understand the baseline needed for a best-in-class payment system.

UNIFY EXPERIENCES

Identify gaps and places for improvement to ensure a cohesive end-to-end experience. Provide a framework product teams can expand upon to solve specific problems.

DIFFERENTIATE TO WIN

Highlight opportunities to make us unique in the market and from our competitors.

Success Metrics

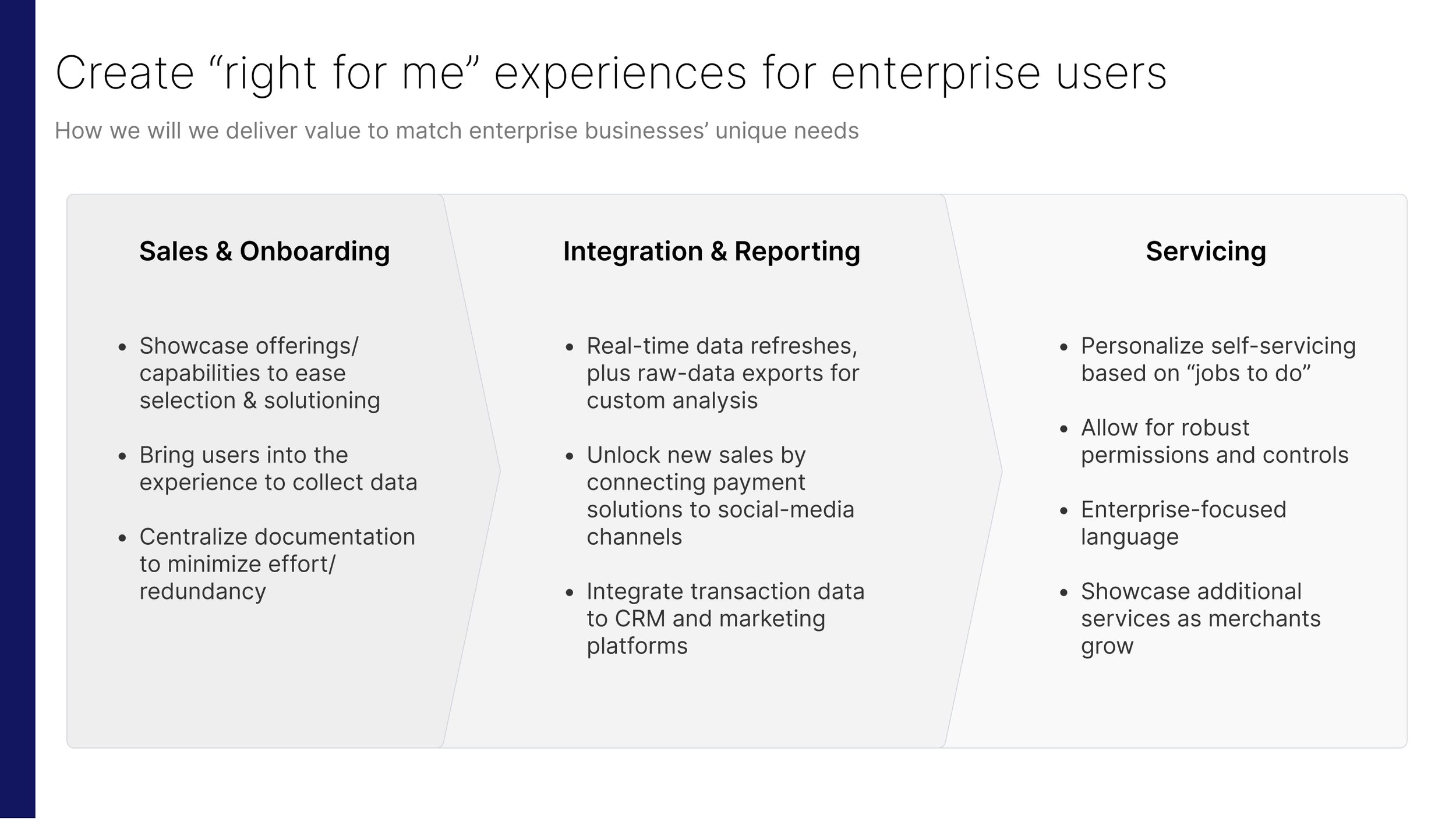

Create “Right for Me” Experiences | The measure of flexible and automated experiences

Expanded and tailored user types and permission

Improved ratings and comments

Increased merchant integration

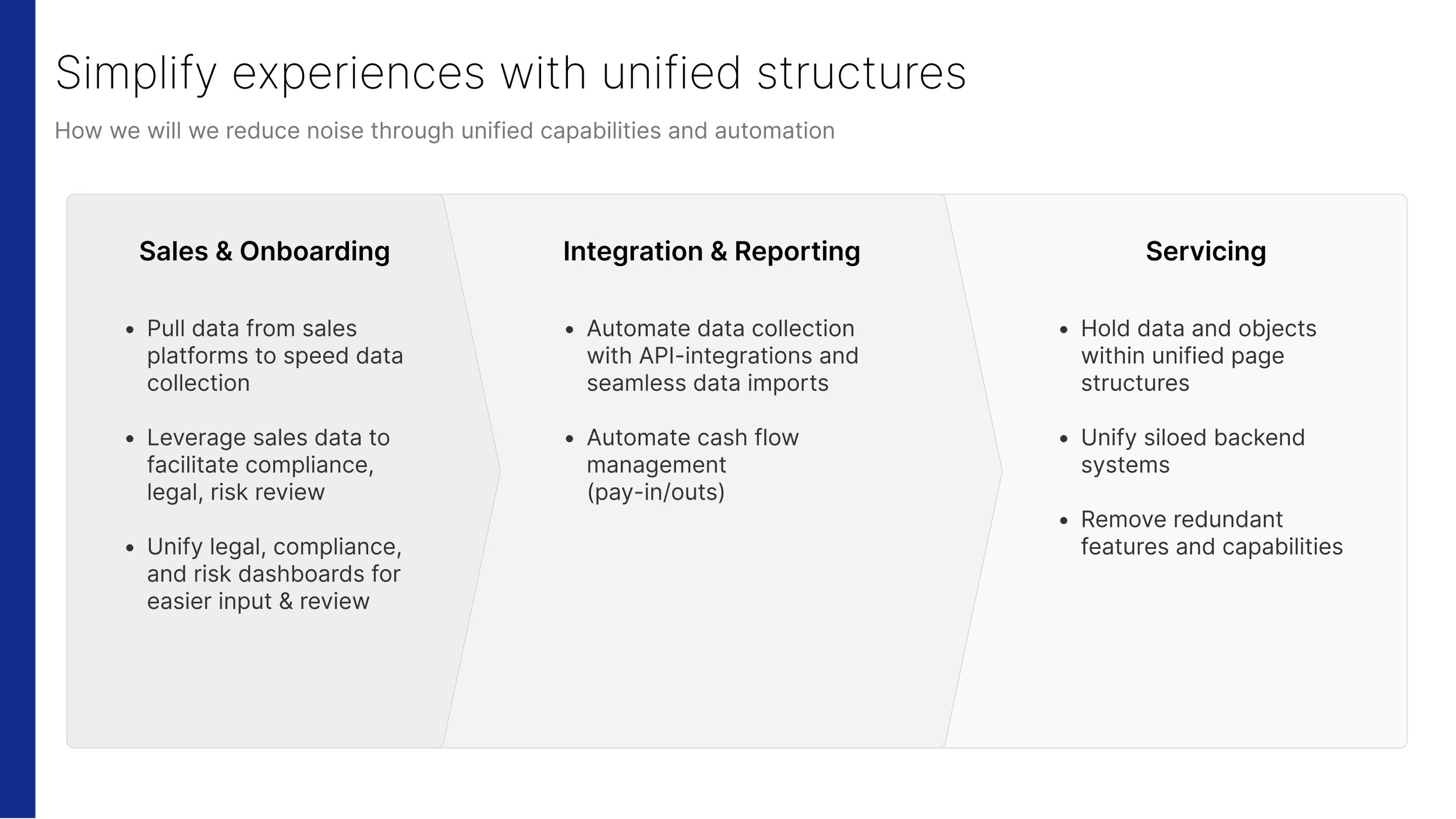

Simplify Unified Structures | The measure of users understanding and trusting the platform

Positive user engagement and comments

Reduced CSM engagement

Transparency

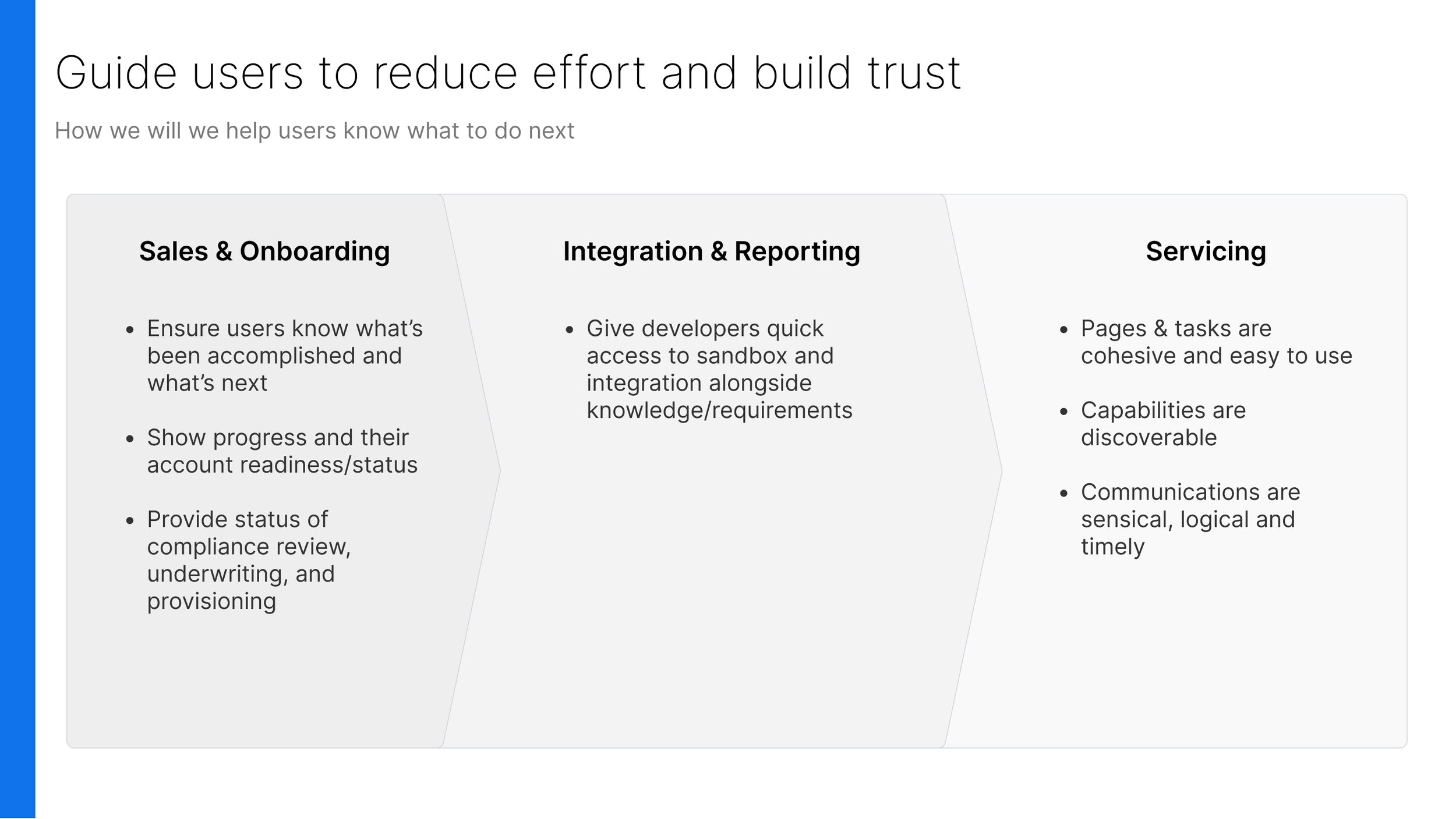

Guide Users | The measure of user speed and ease on the platform

Task completion rate

Onboarding and integration timeline

Increased new feature integration

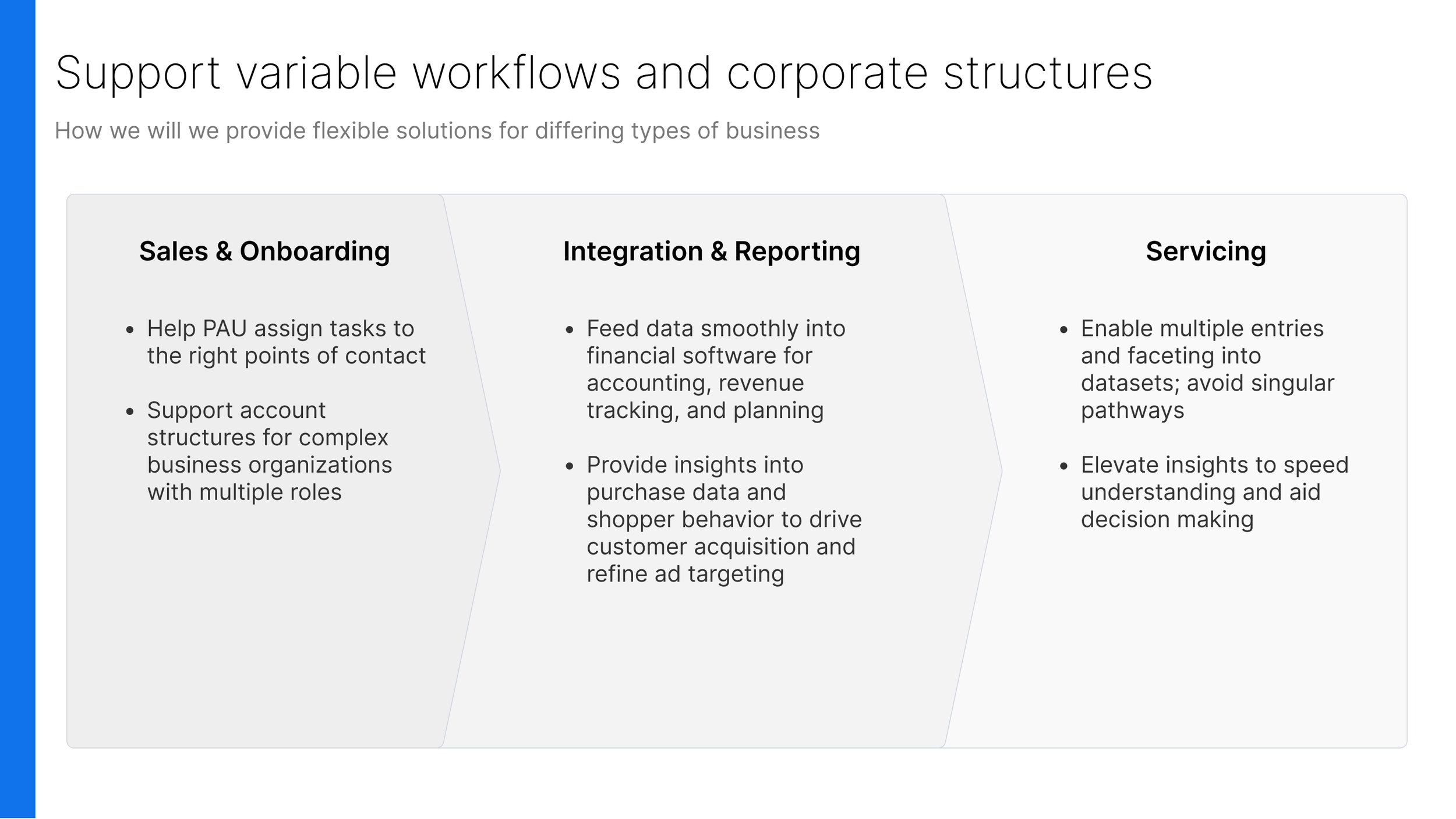

Support Workflows | The measure of scalable and data unified experiences

Multiple segment support

Multiple employee level engagement

Principles

Guiding decision making during the discovery and definition process

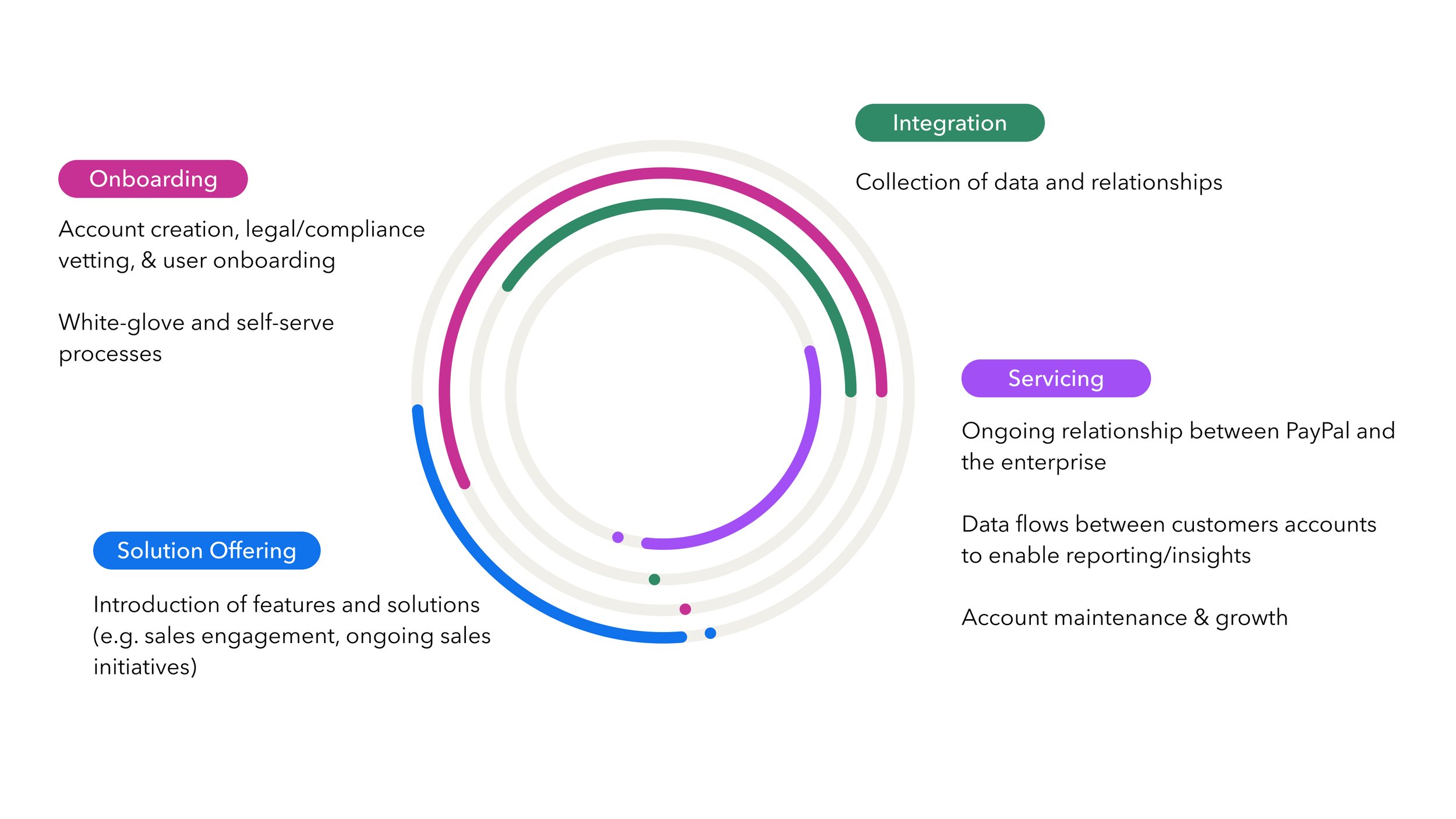

Merchant Lifecycle

Journey Mapping

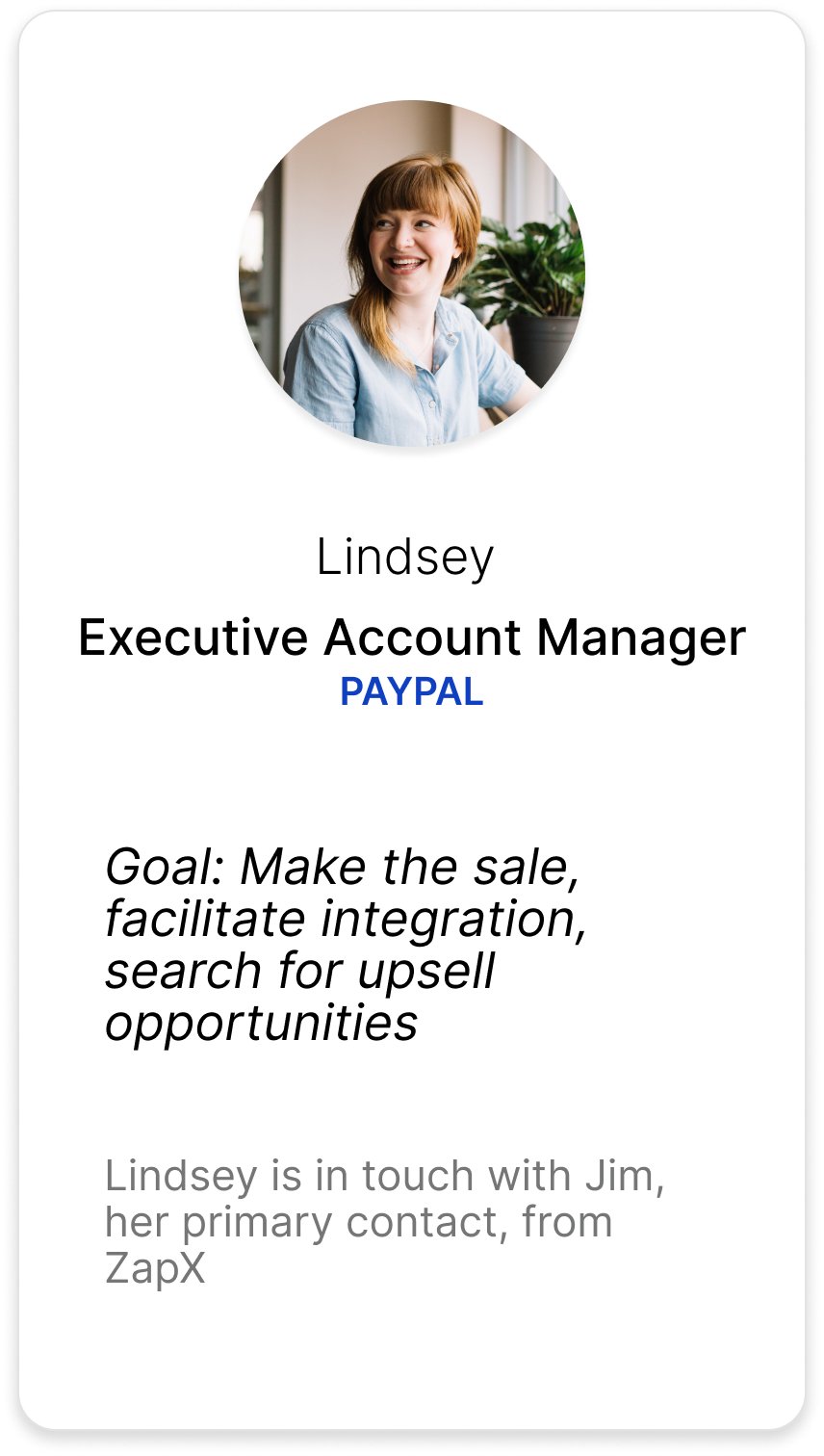

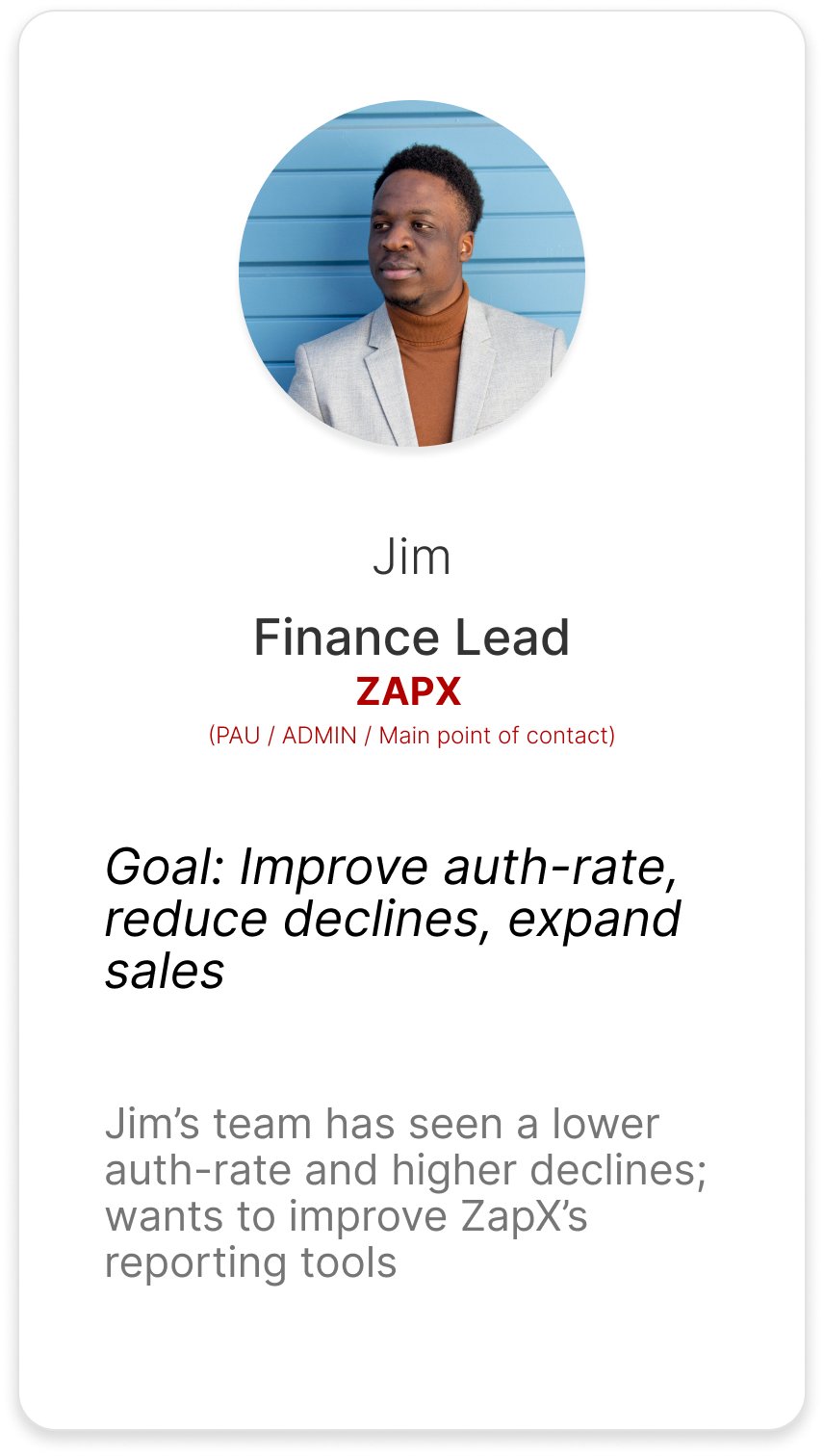

Each designer was designated with a section of the end to end flow. We all had one goal in mind, find the best solution for a Large Enterprise merchant user on a unified platform.

I started by identifying who our users were and where they were most impacted in the journey. I guided the team in adding their flows within swim lanes to visually show where our users were throughout the experience. This gave us insight into the pages that where most critical to the experience and identified current pain points and long term product goals. Because we were creating a framework we kept our solutions high level.

*The team used a fictitious company to help walk through use cases and user journeys

Research

OBJECTIVES:

Identify touch points and journey in the end-to-end experience

How well the concepts meet their needs, and how they compare to the current experience

Answers to remaining questions in key points of the journey

Add details that will help us build more complete personas for key roles

OUTCOME:

Concepts are seen as an improvement on current systems

Easy UX and features that help users get their job done easier are strongly valued (e.g. Accounting – options to save reports, alerts/indicators of disputes/payment failures; Developers – videos for how to implement solution)

WIREFRAMES: Front-book Merchants

*Front-book is a term used for merchants who have yet to integrate with the product.

Every other week the team reviewed with leaders our progress. We started with Front-book merchants, i.e. merchants who had yet to integrate with PayPal. We documented each step a user took whether it was on the platform, an email, phone call, or a third party site, e.g. Salesforce. We clearly explained the manual process users take today, and how the new flows would streamline that process. One of the most impactful features we recommended is the “try before you buy” methodology. Allowing developers to play with the code they would inevitably be integrating with. Our research informed us of who the decision makers where and who influenced their decisions.

The onboarding and integration process is rather intense with complicated risk, underwriting, and compliance documentations. It is a process that isn’t that flexible. But the team was able to hide PayPal’s internal process and make the solution offering, integration, and onboarding process less stressful. This was a big win for the team.

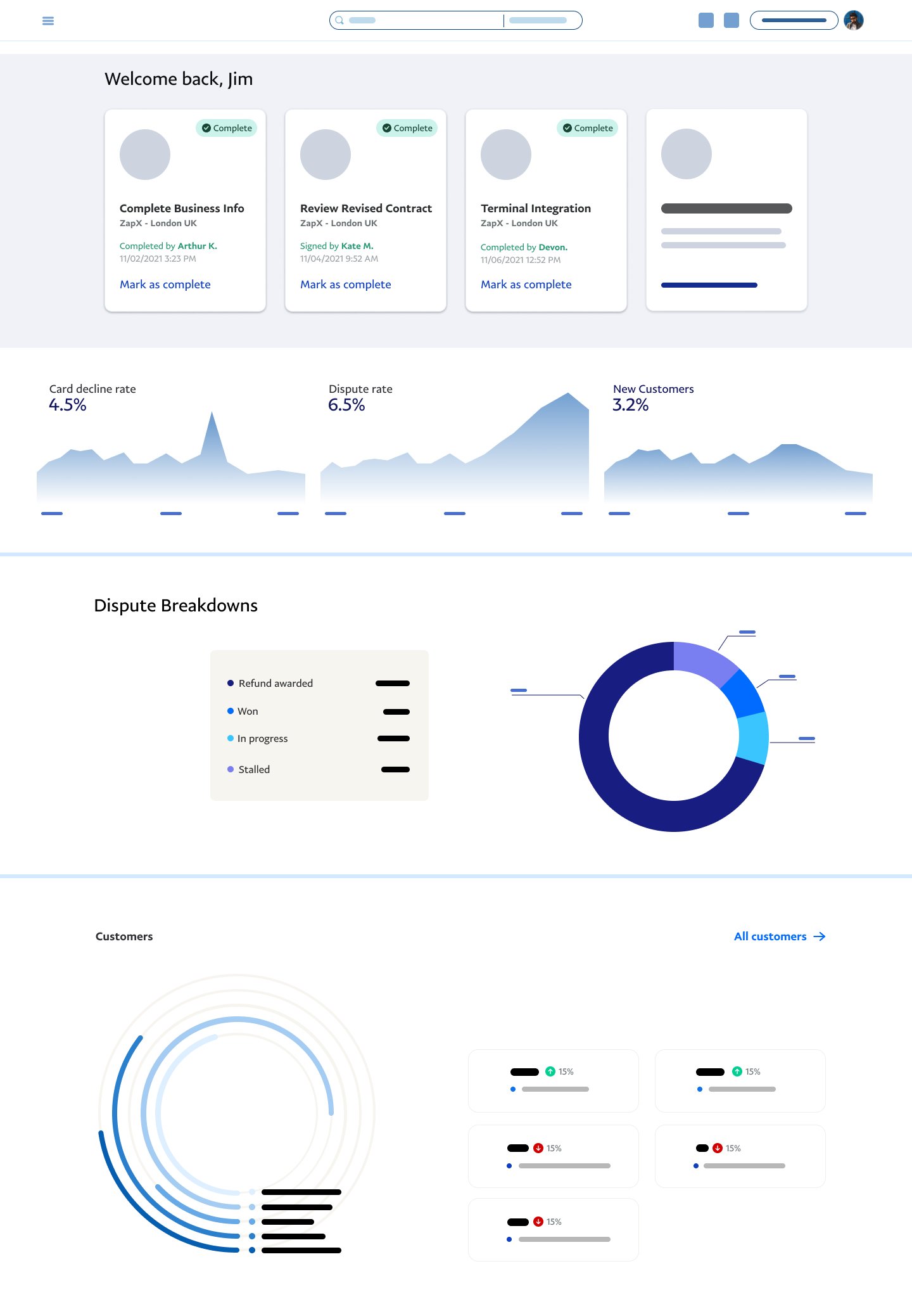

WIREFRAMES: Back-book Merchants

*Back-book merchants are merchants who have already integrated into the PayPal platform

Once a merchant has integrated into the PayPal system and created accounts to begin processing payments, there is an ongoing relationship that is key to helping merchants grow.

Merchant experiences are tailored to the user, permissions, and business type. The team focused on solutions that could scale to automated experiences, but could also fit into the flows that merchants have today.

Our flows solved problems users have expressed in previous research, but we also solved for flow and data presentation problems that evolved overtime from a “broken” platform.

As we built out our flows we spoke with external users to help us make decisions that focus on the user.

Final Designs

Every other week, the team met with stakeholders to realign on goals and objectives. Once we received buy-in from our leaders on the platform vision we linked our wireframes into a prototype based on the journey map (see above under Journey Mapping). Because the flows were complicated and jumped between users, we wanted to show not only a high level understanding of the problems we solved, but allow any viewer to understand the detail flows of the platform. The goal was to create a vision that teams could align to and “plug into”.